Rewarding

Effortless and speedy, accessible from any location. Only one document required

Effortless and speedy, accessible from any location. Only one document required

Depend on our responsible lending and innovative solutions. We protect your privacy and assist in crises

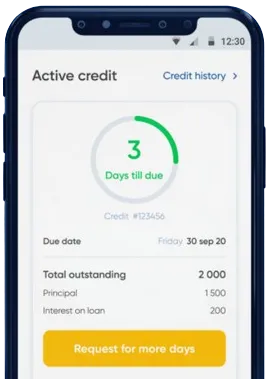

Quick and easy solutions right from your home. We transfer funds instantly and offer loan prolongation

Initiate your application on our app by completing the required form.

Wait briefly for our decision, typically 15 minutes.

Secure your funds, generally processed in just one minute.

Initiate your application on our app by completing the required form.

Download loan app

Instant loans have become increasingly popular in Kenya due to their quick and convenient nature. These loans provide individuals with access to much-needed funds in a short amount of time, making them an ideal solution for emergency situations or unexpected expenses.

One of the main benefits of instant loan is their speedy approval process. Unlike traditional bank loans, which can take weeks to be processed, instant loans are typically approved within a few hours or even minutes. This rapid approval time makes instant loans the perfect option for those in urgent need of funds.

Instant loans in Kenya offer borrowers flexibility when it comes to repayment. Borrowers can choose repayment terms that suit their financial situation and budget, making it easier to repay the loan without causing financial strain.

Additionally, some instant loan providers offer the option to extend repayment periods or make early repayments without incurring penalties, giving borrowers more control over their finances.

Unlike traditional bank loans that often require collateral, instant loans in Kenya are typically unsecured. This means that borrowers do not need to put up any assets as security in order to qualify for a loan. This makes instant loans a more accessible option for individuals who may not have valuable assets to use as collateral.

Another advantage of instant loans in Kenya is that they are often available to individuals with bad credit. Traditional banks and financial institutions typically require a good credit score in order to qualify for a loan, which can be a barrier for those with poor credit history. Instant loans, however, may be more lenient when it comes to credit requirements, making them a viable option for individuals who may have been denied by traditional lenders.

Instant loans in Kenya offer a range of benefits to borrowers, including quick approval, flexible repayment options, lack of collateral requirements, and accessibility to individuals with bad credit. These loans can provide much-needed financial support in times of need and offer a convenient and efficient solution for those facing unexpected expenses or emergencies.

An instant loan is a type of loan that provides quick and easy access to funds. It is typically processed and approved within a short period of time, allowing borrowers to receive the money they need almost immediately.

In Kenya, instant loans are typically offered by mobile lending apps. Borrowers can apply for a loan through the app, submit their personal and financial information, and receive approval (or denial) within minutes.

The requirements for obtaining an instant loan in Kenya may vary depending on the lender, but generally include proof of identification, a mobile phone, a valid bank account, and a regular source of income.

The amount you can borrow with an instant loan in Kenya will depend on the lender and your creditworthiness. Typically, lenders offer loan amounts ranging from Ksh 500 to Ksh 100,000.

Interest rates on instant loans in Kenya can vary widely, but are often higher than traditional bank loans. It is important to carefully review the terms and conditions of the loan before agreeing to borrow money.

If you are unable to repay your instant loan on time, you may incur additional fees and penalties. In some cases, the lender may report your default to credit bureaus, which can negatively impact your credit score.